Research article

DOI: 10.18046/j.estger.2021.161.4010

An examination of linkages between corporate social responsibility and firm performance: Evidence from Moroccan listed firms

Revisión de los vínculos entre responsabilidad social empresarial y desempeño empresarial: evidencia de las empresas marroquíes que cotizan en la bolsa

Revisão das ligações entre a responsabilidade social empresarial e o desempenho empresarial: provas de empresas marroquinas listadas

* Assistant Professor, Institute of Higher Business Studies (IHEC), University of Sfax, Sfax, Tunisia. souhaila.kammoun@ihecs.usf.tn. Corresponding author. https://orcid.org/0000-0001-6523-0681

** Researcher in Economics, Faculty of Economics and Management (FSEG), University of Sfax, Sfax, Tunisia. https://orcid.org/0000-0003-2931-4444

*** Researcher in Finance, Faculty of Economics and Management (FSEG), University of Sfax, Sfax, Tunisia. saharloukil@windowslive.com https://orcid.org/0000-0003-3486-4205

**** Professor, National School of Business and Management (ENCG), Hassan II University of Casablanca, Casablanca, Morocco. a.ibenrissoul@encgcasa.ma https://orcid.org/0000-0002-4902-5140

Received: 2-may-2020 Accepted: 14- apr-2021 Available on line: 22-oct-2021

How to cite: Kammoun, S., Ben Romdhane, Y., Loukil, S. & Ibenrissoul, A. (2021). An examination of linkages between corporate social responsibility and firm performance: Evidence from Moroccan listed firms. Estudios Gerenciales, 37(161), 636-646. https://doi.org/10.18046/j.estger.2021.161.4010

This article analyzes the complexity of the linkages between corporate social responsibility (CSR) and firm performance in Morocco and to decompose this complexity through a bidirectional sense of causality. Using data surveyed from 74 Moroccan listed firms, we conduct an econometric modeling to measure this relationship bilaterally and to investigate the underlying factors behind this association. The empirical study proves the existence of a positive association between CSR and firm performance in both directions in the Moroccan context and suggests that the more social enterprises are, the more they achieve better financial results. The mutual linkage between social and financial aspects allows us to draw some managerial implications and set up further research directions.

Keywords: corporate social responsibility; firm performance; Morocco; ordinary least squares.

El objetivo del artículo es analizar la complejidad de los vínculos entre la responsabilidad social empresarial (RSE) y el desempeño empresarial en Marruecos y descomponer dicha complejidad a través de un sentido bidireccional de la causalidad. Por medio de la recolección de datos de 74 empresas marroquíes que cotizan en la bolsa, se realiza una modelización econométrica para medir esta relación en un sentido bidireccional e investigar los factores que subyacen tras dicha asociación. El estudio empírico demuestra la existencia de una asociación positiva entre la RSE y el desempeño empresarial en ambos sentidos en el contexto marroquí y sugiere que cuanto más sociales son las empresas, estas obtienen mejores resultados financieros. El vínculo mutuo entre los aspectos sociales y financieros permite deducir algunas implicaciones para la gestión y establecer algunas vías de investigaciones futuras.

Palabras clave: responsabilidad social empresarial; desempeño empresarial; Marruecos; mínimos cuadrados ordinarios.

O objetivo do artigo é analisar a complexidade das ligações entre responsabilidade social empresarial (RSE) e desempenho empresarial no Marrocos e decompor esta complexidade através de um sentido bidirecional de causalidade. Através da recolha de dados de 74 empresas marroquinas listadas, realizamos uma modelagem econométrica para medir esta relação em um sentido bidirecional e pesquisar os fatores subjacentes a esta associação. O estudo empírico mostra a existência de uma associação positiva entre a RSE e o desempenho empresarial em ambas as direções no contexto marroquino e sugere que quanto mais sociais as empresas forem, melhores serão seus resultados financeiros. A ligação mútua entre os aspectos sociais e financeiros permite deduzir algumas implicações para a gestão e estabelecer algumas vias de pesquisa futuras.

Palavras chave: responsabilidade social empresarial; desempenho empresarial; Marrocos; mínimos quadrados ordinários.

Over recent years, the issue of corporate social responsibility (CSR) has become an indispensable preo-ccupation parallel to focusing on profitability enhan-cement. Henceforth, in addition to their economic res-ponsibility, today’s companies acknowledge social and environmental responsibilities (Taleb, 2013; Lin, Lin., Chang & Dang, 2015; Lin, Pi-Hsia., De-Wai & Lai, 2018; Meseguer-Sánchez, Abad-Segura, Belmonte-Ureña & Molina-Moreno, 2020). In this line of thinking, a new approach emerges, stipulating that social responsibility creates added value. Following this approach, a great deal of research has been conducted to explore the relationship between corporate social responsibility and the Financial Performance (FP) such as Freeman (1984), Cornell and Shapiro (1987); Becchetti (2007); Waworuntu, Wantah and Rusmanto (2014); Nollet, Filis and Mitrokostas (2016); Rodriguez-Fernandez (2016); Maqbool and Zameer (2018); Kammoun, Loukil and Ben Romdhane (2020a); Kammoun, Loukil, Ben Romdhane and Ibenrissoul (2020b). This paper addresses the following question: What is the nature of the relation-ship between CSR and firm performance in developing countries where CSR is still evolving? To put it another way, can CSR have an effect on Moroccan firms’ fi-nancial performance and does financial performance help improve social behavior in business?

The motivation for this research arises from the mixed results of a growing number of empirical studies which examine the relation between CSR and FP. A thorough literature review reveals that the issue of the relationship between CSR and FP was generally addressed in one way. Even though some studies explain the effect of CSR on FP or the opposite direc-tion, empirical studies investigating the relationship through the direction of causality remain limited. To help address the linkage between the two concepts, further research on the underpinnings of the comple-xity of this relationship is needed, especially since CSR and FP are both multidimensional concepts and there is a wide variety of ways to measure the two concepts and the association between them (Kooskora, Juottonen & Cundiff, 2019).

The overarching purpose of this paper is to explain the complex relationship between CSR and firm per-formance in Morocco through a bidirectional sense of causality and to investigate the main underlying factors behind this association.

The choice is mainly justified by the following rea-sons. First, the study focuses on the relationship between CSR and FP in different industries, which is quite unique. Second, while the majority of empirical studies focus on developed countries, this paper proposes broadening the scope of the study to a de-veloping country such as Morocco, especially since the Moroccan government is on the verge of obliging all companies to devote part of their profits to social responsibility. Given the recent engagement of Mo-roccan companies in CSR, we suggest measuring the firm’s performance through turnover, operational pro-fit and return on equity. Theoretically, the more the firm is performing the higher turnover and profits it will achieve. Third, the complex relationship between CSR and firm performance was evaluated through a unidirectional impact but for a better understanding of this linkage and to assess reverse causality, we sug-gest a bidirectional impact.

Using data surveyed from 74 Moroccan firms and a causal business model, we study the impact of firm per-formance on the improvement of social performance and the impact of CSR strategies on firm performance. We find consistent evidence that firms making more extensive investment in social commitment are more profitable and profitable firms are socially responsible. We prove the positive bidirectional linkage between CSR and firm performance. Important implications for government and decision makers are extracted. We suggest setting up tax and social incentives in favor of firms so they will be encouraged to be more socially committed.

The remaining part of the paper is structured as follows: in the second section, we present a review of the literature on the relationship between CSR and FP in order to formulate the hypotheses underlying our research question. The third section outlines the data-set and the research methodology to examine the rela-tionship between CSR and firm performance in both directions. The fourth section depicts the main findings and sets out managerial implications. The last section concludes and suggests directions for further research.

This section gives an overview of the concepts of CSR and financial performance, sets out the key empirical findings on the connection between the two concepts and outlines the main reasons for the inconclusiveness of the relationship between CSR and FP.

2.1 Concept of CSR

The issue of CSR has attracted the interest of researchers and practitioners alike. Admittedly, the concept of CSR is a fairly old concept whose founda-tions come from philanthropic practices in companies over a century old. Moreover, deficits in social and environmental responsibility have been put forward as a solution to a system in crisis. Thus, CSR has become one of the standard business practices and consequently, one of the major concerns of financial actors. In his book, Bowen (1953) explains the religious roots of CSR and brings about great evolution of the concept both theoretically and conceptually. In this respect, the Islamic financial system with its moral and ethical foundations is nowadays, presented as reliable and concrete innovation in order to remedy the various hazards that disrupt the current economy and to ensure financial stability in harmony with the cha-racteristics of CSR (Williamson, Lynch-Wood & Ram-say, 2006; Al Baali, 2008; Al Haïti, 2009; Alsairfi, 2007; Al-Zahi, 1998). Indeed, Islamic finance has strong in-teractions with the theme of Social Responsibility, as it aims to promote the well-being of all human beings. It also emphasizes the need to preserve resources and the environment for present and future generations. Thus, it is based on more sustainable moral and ethi-cal principles since the entrepreneur is not only guided by profit maximization, but above all by the realization of human welfare. In this sense, we recognise that the entrepreneur has social responsibilities towards all stakeholders, namely: consumers, employees, share-holders and civil society (Ayyash, 2010).

Despite growing academic research on CSR to develop a theoretical framework, there is still no common definition of what CSR is (McWilliams & Sie-gel, 2001; Dahlsrud, 2008) and how it is composed. In his study, Dahlsrud (2008) states 37 definitions of CSR and defines CSR as the integration of social and envi-ronmental preoccupations in a firm’s activities and its interactions with all stakeholders voluntarily (Carrigan & Attala, 2001; Anselmsson & Johansson, 2007). Although CSR has been widely analysed by several researchers with sometimes different or other times similar points of view, the issue is still on-going (Bayoud, Kavanagh & Slaughter, 2012; Aguinis & Glavas, 2012; Asatryan & Březinová, 2014; Wahba & Elsayed, 2015; Jitaree, 2015; Croker & Barnes, 2016; Jamali & Charlotte, 2018; Maqbool & Zameer, 2018). According to Dahlsrud (2008), the confusion is not so much related to the divergence of definitions as to the way CSR is socially constructed in a specific context. From this point of view, some researchers argue that CSR differs across countries (Frynas & Yamahaki, 2016), activity sectors (Colombo, Guerci & Miandar, 2017) or firm size (Spence, Frynas, Muthuri & Navare, 2018). Notwithstanding, this lack of consensus, diver-se research papers have aimed to understand the various elements that influence CSR and examining the financial impacts of socially responsible activities.

2.2 Association between CSR and FP

The concepts of CSR and FP are crucial for the long-term success and sustainability of a business. Accordingly, the relationship between CSR and FP has gained substantial interest in literature and still continues to draw the attention of scholars and practitioners alike. Although many studies have in-vestigated the relationship between CSR and FP, no consistent conclusion has been drawn from empirical evidence, showing positive, negative and no links (Galant & Cadez, 2017; Feng, Chen & Tang, 2018; Mouatassim-Lahmini, 2018; Broadstock, Meyer & Tzeremes, 2019). In the following overview, we provide a brief summary of background literature on the links between the two concepts. Herein, we briefly outline the main findings from three schools of thought.

The first school of thought argues that CSR offers a competitive advantage, which results in an im-provement in a firm's brand image and therefore, its financial condition (Cornell & Shapiro, 1987; Margolis, Elfenbein & Walsh, 2009; Famiyeh, 2017; Galant & Cadez, 2017). For instance, Simionescu and Gherghina (2014) and Waworuntu et al. (2014) found a positive relationship between CSR and FP and confirmed that CSR engagement improves firm performance. Addi-tionally, Rodriguez-Fernandez (2016) analysed the two-way relationship between CSR and FP in Spanish companies and found positive relationships in both directions. The study concludes that the existence of the components of social behaviour in corporate policies should be mandatory to ensure significant profitability. The second school of thought found that corporate social actions have costs that negatively influence their profits (Friedman, 1970; Wright & Ferris, 1997; Peng & Yang, 2014; Nollet et al., 2016). To put it in other terms, investing resources in CSR activities (charity, ecofriendly equipment, pollution control, etc.) involves costs which will deteriorate firm perfor-mance (Maqbool & Zameer, 2018). The third group of researchers found no significant association between CSR and FP (Soloman & Hansen, 1985; Nelling & Webb, 2009). Based on a panel of two-way random and fixed ef-fects, the empirical study by Oyewumi, Ogunmeru and Oboh (2018) shows the existence of a double meaning between the two concepts and confirms that CSR would have little or no effect on the financial performance of companies.

That being said, few researchers have remained less definitive on the issue by talking about "complex" relationships. Barnett and Salomon (2006) developed a hypothesis that explains the existence of an inverted U-shaped parabolic relationship ( ) between CSR and FP. Therefore, it can be argued that CSR positively influences FP up to an optimum level at which the relationship is reversed, where additional socially res-ponsible investment would negatively influence pro-fitability due to the significant expenses incurred for additional social investment.

) between CSR and FP. Therefore, it can be argued that CSR positively influences FP up to an optimum level at which the relationship is reversed, where additional socially res-ponsible investment would negatively influence pro-fitability due to the significant expenses incurred for additional social investment.

As mentioned above, the empirical studies dealing with the relationship between CSR and FP do not reach a clear consensus neither on the meaning nor on the significance of the relationship. The divergent empirical findings may be attributable to theoretical underpinnings, sample selection techniques, variable measurements and estimation model specifications (Feng et al., 2018; Karyawati, Sutrisno & Saraswati, 2018; Kooskora et al., 2019). These mixed results open the doors to further research in developing countries such as Morocco where CSR is still evolving. To in-vestigate the aforementioned problem statement, we propose to empirically test the association between CSR and firm performance of Moroccan listed com-panies and determine the underlying factors behind this association.

2.3 CSR in Morocco

Since the 2000s, several pieces of legislation, sec-torial strategies and government programmes have been promulgated and deployed. Furthermore, a large number of favourable factors enable the emergen-ce of CSR practices in Morocco, such as free trade agreements, the multiplication of subcontracting and foreign direct investment (El Yaagoubi, 2019). Within this context, some subsidiaries of international groups or large national structures have already started to implement social and environmental strategies. In order to encourage and support Moroccan companies to put to put a system in place to reevaluate their assets social sponsoring and sustainable develop-ment, in 2006 the General Confederation of Moroccan Enterprises (CGEM) set up the Social Responsibility Charter for Companies and established the CGEM Label for CSR. Fully in line with the orientations of ISO 26000, the charter is a declaration by all management members of their commitment to defend and sup-port CSR values in their activities and relationships on an ongoing basis. The 35 objectives of this charter are structured around 9 axes: 9 axes: 1. Respect hu-man rights, improvement of working conditions and industrial relations, 2. Protect the environment, 3. Ensure Occupational Safety and Hygiene, 4. Prevent corruption, 5. Enhance transparency in corporate governance, 6. Respect the interests of customers and consumers, 7. Promote Social responsibility with suppliers and subcontractors and the development of societal commitment. In a nutshell, the deployment of a label by an official body made it easier to support companies wishing to set up these new social and sustainable responsibilities.

Over the last few years, many Moroccan listed companies have enhanced their social coordination and environmental practices by implementing socially responsible behaviour or set up CSR strategies. Within this scope, some studies have been done on the link between CSR and FP in the Moroccan context. For instance, using a sample of 20 companies listed on the Casablanca Stock Exchange between 2007 and 2010, Elouidani and Faiçal (2015) analyzed this relation-ship through a static panel model. Taking CSR as a mediating factor, empirical results show the existence of a significant negative impact of CSR on financial performance. Nevertheless, Mouatassim-Lahmini and Ibenrissoul (2016) studied the effect of CSR on the Fi-nancial Performance of Moroccan listed companies and confirmed that CSR has a significant positive effect on performance and if firm performance is measured by the Return on Equity (ROE), the impact is positive but not significant.

Despite ample empirical enquiry, in both developed and developing countries, studies on the relationship between CSR and FP fail to provide conclusive results. On these grounds, there is a need to research the linka-ge between CSR and FP bilaterally. In that connection, we propose measuring FP through turnover, operatio-nal profit and return on equity. The main contribution of this study is to explain the two-way relationship bet-ween Social Responsibility and firm performance in order to better understand this complex relationship in an emerging country where they have recently adopted CSR practices. We discuss in what follows, whether firm performance impacts CSR or vice-versa.

3.1. Scope and aim of the study

As noted earlier, previous studies on the relation-ship between CSR and Financial Performance reveal the lack of unanimity on the nature and meaning of this relationship. The overarching purposes of the empi-rical study is to investigate the relationship between CSR and firm performance of listed Moroccan firms and to show that the linkage between the two variables stems from the nature of CSR, which is inseparable from the activity sector and firm's environment. We measure firm performance through turnover, operational profit and return on equity. Within the sco-pe and aim of this study, we conduct an econometric model to measure this relationship bilaterally. In the first direction, we study the impact that FP has on the improvement of social performance. In the second direction, we study the impact of CSR strategies on firm performance of Moroccan listed companies.

3.2. Sample selection and variables

Our sample is quite specific since our study concerns the results of a data survey. The sample is composed of 74 Moroccan listed firms to whom a questionnaire was addressed. It essentially con-sists of 37 items presented on a five-point response scale assessing CSR engagement. We also collected firm level data from annual reports downloaded from Morocco stock exchange website. We examine the complex relationship between CSR and firm performance through the study of the bidirectional relationship and the potential nonlinear relationship. To score the variable CSR, the method of additional rankings was adopted, assuming that the items have the same weight. The score consists of 5 sub-indexes that are measured through several items. The dimensions used in our study are presented below:

• Dimension 1: Societal commitment: community and local development

• Dimension 2: Consumer issues

• Dimension 3: Loyalty of practices

• Dimension 4: Environment

• Dimension 5: Human rights

• Dimension 5: Governance

We measure FP through turnover, operational profit and return on equity. In fact, firms realizing higher turnover are likely to be more profitable and to reali-ze a higher margin (commercial or production). In this light, profitable firms are those that realize a higher operational profit and return on equity. These ones are often deployed in empirical studies measuring firm performance.

We include some control variables such as the firm’s total liabilities, the firm’s own funds and the in-dustry measure. The Table 1 presents the variable’s indications and measurements.

Next, the summarized statistics for the variables included in our study are shown in Table 2. Notice that on average, turnover is about 4,015 thousand dinars and for equity is about 4,178 MAD (Moroccan Dir-ham). These statistics suggest equity ratio of about (1.04059776). This ratio measures the speed that the firm fructified its own resources. This ratio is over the unit which reflects a high speed to transform equities in turnover. The mean value of operational profit is about 1437 MAD. To interpret this value, we should compare it to industry average. But we can analyze the operational profit ratio compared to turn-over. In fact, operational profit is about a third of turnover, suggesting a high economic return and good operational management which can be explained, in part, by the repartition of our sample. In fact, 87.83% of the firms belong to the industrial sector characteri-zed by the high value added. Talking about liabilities, we find that on avera-ge, long-term debts and other non-current liabilities value about 3,347 MAD. Compared to equities, 4,178 MAD, it appears that Moroccans firms rely more on self-financing. On the other hand, ROE is on average about 33.88%. This reflects that stakeholders have a profitable investment with a maximum value of 80.19%.

In addition, we find that on average, Moroccan firms are socially committed by 83.59%. This could be explained by the fact that all the firms have got a high CSR index varying between 81.25% and 85.94%. This choice favors the objective of our research since our knowledge contributes to study the impact CSR has on firm performance. Doing so, we attempt to de-mystify the social engagement arena and the gradual widespread presence in Moroccan firms.

|

Variable |

Indication |

Measurement |

|

Corporate social responsibility |

CSR |

An index constructed from 5 sub-indexes each one consists of several items. |

|

Firm performance |

Turnover |

Total sales |

|

Op. Profit |

Operational profit |

|

|

ROE |

Return on equity |

|

|

Control variables |

Liab |

Total liabilities |

|

Equity |

Firm’s own funds |

|

|

Industry |

A dummy variable indicating if the firm belong to the industrial sector |

Source: own elaboration.

|

Mean |

Std. Err. |

Min |

Max |

|

|

Equity |

4,178 MAD |

1.13 |

1.92 |

6.43 |

|

Turnover |

4,015 MAD |

9.99 |

2.02 |

6.01 |

|

Op. Profit |

1,437 MAD |

4.30 |

5.79 |

2.30 |

|

ROE |

0.0338836 |

0.6546925 |

-4.105347 |

0.8019352 |

|

Liab |

3,347 MAD |

9.31 |

1.49 |

5.20 |

|

CSR |

0.8359588 |

0.0117688 |

0.8125037 |

0.8594139 |

|

Proportion |

Std. Err. |

[95% Conf. |

Interval] |

|

|

Industry |

||||

|

0 |

0.1216216 |

0.0382547 |

0.0635163 |

0.2203737 |

|

1 |

0.8783784 |

0.0382547 |

0.7796263 |

0.9364837 |

Source: own elaboration.

3.3. Regression models

We turn now to study the complex relationship between firm performance and CSR rating. To recap, we will test two regression models. First, the impact of the performance on the development of a social commitment and second the impact of CSR on firm performance. This brings us to test the following two guiding hypotheses:

• H1: Firm performance is a key determinant of its involvement in social acts.

• H2: Social commitment improves firm performance (FP)

In order to assess these relationships, the following models can be written as:

(1)

(1)

Where corporate social responsibility (CSR) is a function of firm performance (FP) and other control variables (CV) are supposedly related to CSR.

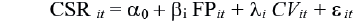

(2)

(2)

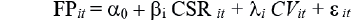

Our regression models (1) and (2) could be written respectively as:

(model 1)

(model 1)

(model 2)

(model 2)

where i is the cross-section dimension (i =1,…N), t is time dimension (1,…8), y is the dependent variable (CSR) and (FP) for firm i and period t, CSRit is the corporate so-cial responsibility and FP is firm performance,  i and

i and  i are coefficients to be estimated and

i are coefficients to be estimated and  it is the error term. The parameters of the empirical models are estimated using OLS regression. For this purpose, some diagnostic autocorrelation and multi-collinearity tests are initially performed.

it is the error term. The parameters of the empirical models are estimated using OLS regression. For this purpose, some diagnostic autocorrelation and multi-collinearity tests are initially performed.

Table 3 shows the correlation between the in-dependent variables. We found that turnover and operational profit are highly and significantly correlated and at 10% this is expected since the operational profit is determined by the firm’s turnover. Otherwise, there is no significant problem of autocorrelation between variables since all values are less than 0.35 which is largely inferior to that specified by Kennedy (1985).

We then carry out Variance Inflation Factor (VIF) ana-lysis (Table 4) as recommended by Gujarati (2003) to test for multi-collinearity. Tolerance of a variable is the expression of 1-Rj2 of the regression of each varia-ble on the P-1 other independent variables. The closer it is to zero, the more likely there will be a problem of multi-collinearity. It can have a lower limit of 0.1, 0.2 or 0.25 depending on the chosen limit of the VIF. The VIF corresponds to the expression 1 / (1- 1-Rj2). According to Fox (1991), if this factor reaches 4 or 5, a risk of multi-collinearity is present. However, this limit is tolerated by Chatterjee et al. (2000) up to 10. Unless the VIF is above 10 and the tolerance value is below 0.10, there is a multi-collinearity problem among variables. However, the values of VIF are all below 10 and the tolerance values are above 0.10.

Our sample includes data from 74 Moroccan listed firms from a broad variety of industries who were surveyed plus their annual reports. We figure that on average, total liabilities are about half of total turnover and operational profit is less than half. We also find that the return on equity is on average about 33.91 % fluctuant from a negative value to 0.8 with a low value of standard deviation which is about 0.65554. In addition, we notice that on average the CSR scope is high and close to 1 with a low standard deviation of about 0.101 fluctuating from 0.554 to 1.

These results suggest that firms in Morocco are highly socially committed and this is in favor of our research topic to figure out the development process of CSR and firm performance.

Empirical results show that while operational profit does have a positive and significant impact on CSR at 5% level (Table 5), this social commitment does posi-tively and significantly impact turnover by 10% level (Table 6). The underlying objective is to explain this complex relationship through a bidirectional sense of causality. In the first direction, this implies that the better a company performs economically, the better it will perform socially. More precisely, the higher the company is financially performing, the more it will contribute to public interest causes and improves the societal impacts of its products. In fact, Mouatassim-Lahmini and Ibenrissoul (2016) empirically confirmed that financial and economic performance does enhance social commitment of the firm.

Table 3. Pairwise correlation matrix

|

Turnover |

Liab |

Op. Profit |

ROE |

Equity |

CSR |

Industry |

|

|

Turnover |

1.0000 |

||||||

|

Liab |

0.3590* |

1.0000 |

|||||

|

0.0020 |

|||||||

|

Op. Profit |

0.9837* |

0.2970* |

1.0000 |

||||

|

0.0000 |

0.0113 |

||||||

|

ROE |

-0.2084 |

0.0264 |

-0.2544* |

1.0000 |

|||

|

0.0748 |

0.8257 |

0.0287 |

|||||

|

Equity |

-0.0142 |

-0.0626 |

-0.0784 |

0.0597 |

1.0000 |

||

|

0.9045 |

0.6012 |

0.5065 |

0.6133 |

||||

|

CSR |

0.2746* |

0.2207 |

0.2946* |

0.0652 |

-0.2572* |

1.0000 |

|

|

0.0179 |

0.0625 |

0.0108 |

0.5813 |

0.0269 |

|||

|

Industry |

-0.1527 |

-0.0927 |

-0.1382 |

0.0721 |

-0.0007 |

-0.1871 |

1.0000 |

|

0.1941 |

0.4384 |

0.2403 |

0.5417 |

0.9955 |

0.1104 |

*** p<0.01, ** p<0.05, * p<0.1.

Source: own elaboration.

Table 4. Tolerance Value and Variance Inflation Factor

|

Variable |

VIF |

1/VIF |

|

Op. Profit |

1.03 |

0.974737 |

|

Industry |

1.02 |

0.980772 |

|

Equity |

1.01 |

0.993712 |

|

Mean VIF |

1.02 |

|

|

Variable |

VIF |

1/VIF |

|

CSR |

1.09 |

0.918168 |

|

Liab |

1.05 |

0.948263 |

|

Industry |

1.05 |

0.954298 |

|

ROE |

1.01 |

0.987217 |

|

Mean VIF |

1.05 |

|

Source: own elaboration.

The other sense of causality suggests that CSR is, in counterpart, supporting the firm’s expansion and performance. To strengthen their positions, Moroccan listed companies choose social responsibility as a financial lever and a comparative advantage. This means that the better the company performs socially, the better it performs economically and financially. From this point of view, CSR can be considered as a financial performance-boosting tool by Moroccan listed companies. Doing so, we confirm previous research by Taoukif (2014), Crifo and Rebérioux (2015), Bennouna (2016). This finding can be explained by the fact that listed companies invest in social commitment in order to win society’s respect and to improve their image and reputation (Abbott & Monsen, 1979; Fombrun & Shan-ley, 1990; Mouatassim-Lahmini & Ibenrissoul, 2016; Mouatassim-Lahmini, 2018). Industrial companies which invest in CSR activities and succeed in setting up CSR strategies can reconstruct their corporate and social image more easily compared to companies without such practices (Bhattacharya & Sankar, 2004). Moroccan listed companies which implement CSR practices are likely to invest in products which enable greater safety and environmental protection. In brief, the societal commitment of Moroccan listed com-panies through social causes and improvement of the impacts on society of products could be the best way to improve their image and reputation, which, in turn, can have a consequent impact on their turnover. This finding is supported by the results of the survey. In fact, more than 70% of the companies surveyed stated that strengthening the company's image and reputation would be the motivating factor to implement CSR strategies.

Furthermore, it is also interesting to mention that equities are not a determinant of the development of a firm’s social responsibility (see Table 5). More precisely, equities do have a 5% negative impact on CSR. This result means that stockholders are not in favour of social commitment. This could be explained by the fact that they would rather increase their return on the be-half of their social image. Consequently, costs incurred in CSR activities (charity, ecofriendly equipment, better working conditions, pollution control) will squeeze the profitability out of the firm (Maqbool & Zameer, 2018). This sense was confirmed by Vitezić, Vuko and Mörec (2012), Siew, Balatbat and Carmichael (2013), Dkhili, Ansi and Noubbigh (2014), Hirigoyen and Poulain-Rehm (2015), Dumitrescu and Simionescu (2015), Jiang and Qishen (2015), Chetty, Naidoo and Seetharam (2015), Jianwei (2015) and Lin, Chang and Dang (2015). In this regard, Moroccan companies that integrate social, environmental, and economic concerns into their ac-tivities should more promote their CSR strategy to investors and stockholders through extra-financial or CSR reporting. From 2020 onwards, the extra-financial report should be included in the management report and may even result in a CSR report, which is more ac-cessible to stockholders, shareholders, stakeholders and the general public. It is a periodic, usually annual, document published by companies to present the actions taken to reduce its environmental and social impact.

We also find that liabilities do have a positive and a significant positive 1% impact on turnover su-ggesting that the liabilities terms positively impact the working capital of the firm which is determinant to the operational cycle and consequently, to the firm’s turnover. On the other hand, we find that ROE has got a significant negative 5% impact on the firms’ turnover. These results are confirmed by Elouidani and Faiçal (2015) and Maqbool and Zameer (2018). In fact, our em-pirical findings are corroborated with the predictions of the studies by Chetty et al. (2015), Mikołajek-Gocejna (2016), Kablan (2017), Laskar (2018), Platonova, Asutay, Dixon and Mohammad (2018), Lin, Pi-Hsia, HDe-Wai and Lai (2018) and Schönborn, Berlin, Pinzone, Hanisch, Georgoulias and Lanz (2019). It is obvious now that when investing in social commitments even when some stakeholders are not in favour, the firm sees its sales. This could be explained by the improvement of the firm’s image among customers and more globally in society. Furthermore, an ethical image can also contribute to the company's commercial performance by establishing a relationship of trust and customer loyalty.

Based upon key findings, our empirical study shows that there is a positive association between CSR and financial performance in both directions. This implies that the more companies improve the social impacts of their products, the higher financially performing they will be, and, the better they are performing financially, the more they will improve the social impacts of their products. That being said, Moroccan companies should give more serious thought to implementing CSR stra-tegies as a lever for performance and growth. This involves awareness campaigns to encourage private companies to respect their social commitments and to progressively integrate CSR into the heart of the firm’s strategies as well as into mobilizing its stakeholders in the process. Doing so, our empirical study is able to fill the gap in literature on the bidirectional connection between CSR and firm performance. Future studies on a potential mediator effect of other factors would improve our knowledge about the impact of CSR on FP and vice-versa.

The present study set out to investigate the rela-tionship between CSR and the financial performance of Moroccan firms. Using ordinary least squares (OLS) regression on a sample of 74 Moroccan listed firms, we have attempted to examine the direction of causality between social and financial performance. To our knowledge, this has never been studied in the Moroc-can context before. Moreover, our data is extracted from a unique survey composed of 37 items presented in the form of a five-point response scale assessing CSR engagement.

Broadly, the outcomes of the empirical study prove that firm performance is a determinant of social engagement and that socially responsible strategies are linked to financial performance. On the basis of the foregoing findings, two main factors will help to better understand the relationship between CSR and financial performance. Firstly, the existence of a positive co-rrelation between CSR and the operating result allows us to conclude that the existing mechanisms which regulate the operating cycle can serve as a guide for managers and investors when making their operating and investment decisions. Secondly, the empirical re-sults show that while stakeholders are not in favor of CSR commitment investment, liabilities considered as external funds lead to an improvement in social beha-vior. Even though, the literature review on the matter is quite distinct, our empirical results confirm that the stakeholder theory provides the most solid basis for the full study. This mutual feedback between social and financial aspects is the key pillar to maintaining ethi-cal business behaviour and building a good reputation. In sum, it can be concluded that the increase in social responsibility leads to an improvement in financial performance and, moreover, the companies enjoy greater financial strength exhibit an index of improved social behavior. The literature review on the matter is quite distinct, but our empirical results confirm that the stakeholder theory provides the most solid basis for the full study.

In the Moroccan context, CSR is still evolving. Henceforth, the ensuing challenge for Moroccan firms lies in integrating CSR activities in core business processes and implementing CSR strategies as they undertake profit-making activities. From this perspective, CSR calls on firms to rethink their stra-tegies. Moroccan firms have to find innovative ways to increase their possibilities to invest in environmental products and social innovations to improve their profits and thriving in the long term. For instance, inte-grating environmental and social issues often leads to to product as well as social innovations, involving the management or organization of the firm. Further, CSR should be considered as an important element for growth by finding the best practices to integrate into business strategies and create new ways to build loyalty, retain customers and more generally to earn respect from society.

Table 5. CSR rating and its association with firm performance

|

Score CSR |

Coef. |

Std. Err. |

t |

P>|t| |

[95% Conf. Interval] |

|

Op. Profit |

6.97** |

3.03 |

2.30 |

0.024 |

9.38 1.30 |

|

Equity |

-3.00** |

1.39 |

-2.17 |

0.034 |

-5.76 -2.37 |

|

Industry |

0.0467706 |

0.0339356 |

1.38 |

0.173 |

-0.0209118 0.114453 |

|

_cons |

0.7948996*** |

0.0318377 |

24.97 |

0.000 |

0.7314014 0.8583979 |

|

F(P-value) |

4.6 (0.0054) |

||||

|

R-squared |

0.1646 |

||||

*, **, and ***, denote significantly different from zero at the 0.01, 0.05 and 0.10 level, respectively.

Source: own elaboration.

Table 6. The impact of the social commitment of the firm on the firm performance

|

Turnover |

Coef. |

Std. Err. |

t |

P>|t| |

[95% Conf. Interval] |

|

CSR |

1.77* |

9.50 |

1.86 |

0.067 |

-1.27 3.67 |

|

Liab |

0.3245937*** |

0.1147536 |

2.83 |

0.006 |

0.09 0.55 |

|

ROE |

-2.91** |

1.42 |

-2.05 |

0.044 |

-5.74 -7.84 |

|

Industry |

1.88 |

2.87 |

0.66 |

0.514 |

-3.85 7.61 |

|

_cons |

-1.29 |

7.89 |

-1.64 |

0.106 |

-2.87 2.81 |

|

F(P-value) |

4.91*** (0.0016) |

||||

|

R-squared |

0.2267 |

||||

*, **, and ***, denote significantly different from zero at the 0.01, 0.05 and 0.10 level, respectively.

Source: own elaboration.

Further studies can investigate the relationship between CSR and innovation (CSR-driven innovation) and show how CSR creates value in terms of innova-tion. In that light, firms must find the means to measure the added value from the impact of their CSR activities. Put in other terms, managers should understand and assess the profits from CSR and be able to reorient CSR towards a strategic perspec-tive. Within this framework, cost-benefit analysis may be an appropriate method as a valuation method and a decision support method. This method helps to evaluate a CSR project in monetary terms and determine the economic value of the project.

It will be also interesting to study the possibility to establish a real and representative index to measure CSR since calculating CSR complicates the comparison of studies; thus, a universal index representing social behavior would help to standardize future empirical analyzes.

Conflict of interest The authors declare no conflict of interest.

Abbott, W., & Monsen, J. (1979). On the measurement of corporate social responsibility: self-reported disclosures as a method of measuring corporate social involvement. Academy of Management Journal, 22(3), 501-515. https://doi.org/10.5465/255740

Al Baali, A. (2008). La supervision efficace de la Charia dans les institutions financières islamiques, dans les Actes de la troisième. Conférence mondiale sur l’économie islamique à l’université Umm Al Qora.

Al Haïti, A. (2009). L’impact de la supervision de la charia sur la conformité des banques islamiques aux règles de la charia, dans Actes de la Conférence des banques islamiques entre réalité et attentes.

Alsairfi, M. (2007). La responsabilidad Social de la administración (en árabe), Ed. Dar Al-Wafaa.

Al-Zahi, A. (1998). Les implications de la structure du marché bancaire islamique sur le potentiel de risque et la stabilité financière, structure de la banque islamique.

Anselmsson, J., & Johansson, U. (2007). Corporate social responsibility and the positioning of grocery brands: An exploratory study of retailer and manufacturer brands at point of purchase. International Journal of Retail & Distribution Management, 35(10), 835-856.

Asatryan, R., & Březinová, O. (2014). Corporate social responsibility and financial performance in the airline industry in central and eastern Europe. Acta Universitatis, Agriculturae et Silviculturae Mendelianae Brunensis, 62, 633-639. https://doi.org/10.11118/actaun201462040633

Ayyash, M. S. (2010). Nature et importance de la responsabilité sociale des banques islamiques.

Aguinis, H., & Glavas, A. (2012). What We Know and Don’t Know About Corporate Social Responsibility: A Review and Research Agenda. Journal of Management, 38(4), 932-968. https://doi.org/10.1177/0149206311436079

Barnett, M., & Salomon, R. M. (2006). Beyond dichotomy: The curvilinear relationship between responsibility and financial performance. Strategic Management Journal, 27(11), 1101-1122. https://doi.org/10.1002/smj.557

Bayoud, N.S., Kavanagh, M., & Slaughter, G. (2012). Factors influencing levels of corporate social responsibility disclosure by Libyan firms: A mixed study. International Journal of Economics and Finance, 4, 13–29. https://doi.org/10.5539/ijef.v4n4p13

Becchetti, L. (2007). Corporate social responsibility: not only economic and financial performance. Revue Finance & Bien Commun, 3, 152-158. https://doi.org/10.2139/ssrn.928557

Bennouna, A. (2016). Impact du management stratégique de la RSE sur la performance globale de l’entreprise : Cas des entreprises marocaines labellisées RSE « Label CGEM ». Thèse de doctorat en Sciences Economiques et de Gestion. Fès : Université Sidi Mohamed Ben Abdellah.

Bhattacharya, C.B., & Sankar, S. (2004). Doing better at doing good: when, why, and how consumers respond to corporate social initiatives. California Management Review, 47(1), 9-24. https://doi.org/10.2307/41166284

Bowen, H. R. (1953). Social responsibility of the businessman. New York: Harpers and Brothers.

Broadstock, D., Meyer, M.R., & Tzeremes, N.G. (2019). Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. Journal of Business Research, 119, 99-110. https://doi.org/10.1016/j.jbusres.2019.07.014

Chatterjee, S., Hadi, S., & Price, B. (2000). Regression Analysis by Examples (3rd Ed.). New York: Wiley.

Carrigan, M., & Attala, A. (2001). The myth of the ethical consumer – do ethics matter in purchase behaviour? Journal of Consumer Marketing, 18, 560-577. https://doi.org/10.1108/07363760110410263

Chetty, S., Naidoo, R., & Seetharam, Y. (2015). The Impact of Corporate Social Responsibility on Firms’ Financial Performance in South Africa. Contemporary Economics, 9(2), 193-214. https://doi.org/10.5709/ce.1897-9254.167

Colombo, S., Guerci, M., & Miandar, T. (2017). What do unions and employers negotiate under the umbrella of corporate social responsibility: Comparative evidence from the Italian metal and chemical industries. Journal of Business Ethics, 155(4), 1–18. https://doi.org/10.1007/s10551-017-3503-9

Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance. Financial Management, 16(1), 2-18. https://doi.org/10.2307/3665543

Crifo, P., & Rebérioux. A. (2015). Gouvernance et responsabilité so-ciétale des entreprises: nouvelle frontière de la finance durable? Revue d'Economie Financière, 1(117), 205–223.

Croker, N., & Barnes, L. R. (2016). Epistemological development of corporate social responsibility: The evolution continues. Social Responsibility Journal, 13(2), 279–291. http://dx.doi.org/10.1108/SRJ-02-2016-0029

Dahlsrud, A. (2008). How corporate social responsibility is defined: an analysis of 37 definitions. Corporate Social Responsibility and Environmental Management, 15(1), 1–13.

https://doi.org/10.1002/csr.132

Dkhili, H., Ansi. H., & Noubbigh, H. (2014). Responsabilité sociétale et performance financière dans les entreprises tunisiennes. La Revue des Sciences de Gestion, 3, 267–268.

Dumitrescu, D., & Simionescu, L. N. (2015). Empirical research regarding the influence of corporate social responsibility (CSR) activities on companies, employees and financial performance. Economic cybernetics studies, 49(3), 52–66.

Elouidani, A., & Faiçal. Z. (2015). Corporate social responsibility and financial Performance. African Journal of Accounting, Auditing and Finance, 4(1), 74–85. https://doi.org/10.1504/AJAAF.2015.071749

El Yaagoubi, J. (2019). Impact de la responsabilité sociale des entreprises cotées en bourse de casablanca sur leur performance financière. Centre des Etudes Doctorales: Sciences Economiques et Gestion. Laboratoire de Recherche: Entrepreneuriat et Management des Organisations (LABEMO).

Famiyeh, S. (2017). Corporate social responsibility and firm's performance: Empirical evidence. Social Responsibility Journal, 13(2), 390–406. https://doi.org/10.1108/SRJ-04-2016-0049

Feng, Y., Chen, H., & Tang, J. (2018). The Impacts of Social Responsibility and Ownership Structure on Sustainable Financial Development of China’s Energy Industry. Sustainability, 10(2), 1–15. https://doi.org/10.3390/su10020301

Fombrun, C., & Shanley, M. (1990). What’s in a name? Reputation building and corporate strategy. Academy of Management Journal, 33(2), 233–258. https://doi.org/10.5465/256324

Fox, J. (1991). Regression Diagnostics. Newbury Park: SAGE Pu-blications. https://dx.doi.org/10.4135/9781412985604

Freeman, R. E. (1984). Strategic Management: A Stakeholder Approach. Boston: Pitman.

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York Times Magazine, 32(33), 122–124.

Frynas, J., & Yamahaki, G. (2016). Corporate social responsibility: Review and roadmap of theoretical perspectives. Business Ethics a European Review, 25(3), 258–285. https://doi.org/10.1111/beer.12115

Galant, A., & Cadez, S. (2017). Corporate social responsibility and financial performance relationship: A review of measurement approaches. Economic Research- Ekonomska Istraživanja, 30(1), 676–693. https://doi.org/10.1080/1331677X.2017.1313122

Gujarati, D. (2003). Basic Econmetrics (4e ed). New York: McGraw-Hill.

Han, J. (2015). Study on Correlation between CSR Performance and Financial Performance. Proceedings of the 2015 International Conference on Economy, Management and Education Technology, Advances in Social Science, Education and Humanities Research. Atlantis Press. https://doi.org/10.2991/icemet-15.2015.27

Jamali, D., & Charlotte, K. (2018). Corporate social responsibility in developing countries as an emerging field of study. International Journal of Management Reviews, 20(1), 32–61. https://doi.org/10.1111/ijmr.12112

Jiang, L., & Qishen, Y. (2015). The Relationship between Corporate Social and Financial Performance: Evidence from Chinese Heavy-polluting Industries. Department of Business Studies. Upssala University. Retrieved from: http://www.diva-portal.se/smash/get/diva2:823296/FULLTEXT01.pdf

Jitaree, W. (2015). Corporate social responsibility disclosure and financial performance: Evidence from Thailand. Thèse de doctorat. Université de Wollongong.

Hirigoyen, G., & Poulain-Rehm, T. (2015). Relationships between Corporate Social Responsibility and Financial Performance: What is the Causality? Journal of Business & Management, 4(1), 18-43. https://doi.org/10.12735/jbm.v4i1p18

Kablan, M. (2017). A Comparative Study on the Financial Performance before and After the Implementation of Corporate Social Responsibility at the Company "Al madar Telecommunication Company as a Case Study”. Journal of Accounting and Auditing: Research & Practice, 993686. https://doi.org/10.5171/2017.993686

Kammoun, S., Loukil, S., & Ben Romdhane, Y. (2020a). The impact of Firm Performance and Corporate Governance on Corporate Social Responsibility: Evidence from France. In I.S. Paiva & L.C. Carvalho (Ed.), Conceptual and Theoretical Approaches to Corporate Social Responsibility, Entrepreneurial Orientation, and Financial Performance (pp. 266-288). Pennsylvania: IGI GLOBAL. https://doi.org/10.4018/978-1-7998-2128-1.ch014

Kammoun, S., Loukil, S., Ben Romdhane, Y., & Ibenrissoul, A. (2020b). The relationship between CSR, Corporate Governance and Firm Performance: Evidence from Moroccan listed firms. In I.S. Paiva & L.C. Carvalho (Ed.), Conceptual and Theoretical Approaches to Corporate Social Responsibility, Entrepreneurial Orientation, and Financial Performance (pp. 289-304). Pennsylvania: IGI GLOBAL. https://doi.org/10.4018/978-1-7998-2128-1.ch015

Karyawati, G P., Sutrisno, B., & Saraswati. E. (2018). The Complexity of Relationship between Corporate Social Responsibility (CSR) and Financial Performance. Emerging Markets Journal, 8(2), 18-25. https://doi.org/10.5195/emaj.2018.155

Kennedy, P.E.P. (1985). A Guide to Econometrics (2nd ed.). Cambridge: The MIT Press.

Kooskora, M., Juottonen, M., & Cundiff, K. (2019). The Relationship Between Corporate Social Responsibility and Financial Performance (A Case Study from Finland): How Businesses and Organizations Can Operate in a Sustainable and Socially Responsible Way. Sustainability, 4(25), 471–49. https://doi.org/10.1007/978-3-030-03562-4_25

Laskar, N. (2018). Impact of corporate sustainability reporting on firm performance: an empirical examination in Asia. Journal of Asia Business Studies, 12(4), 571–593. https://doi.org/10.1108/JABS-11-2016-0157

Lin, C., Chang, R., & Dang, V. T. (2015). An Integrated Model to Explain How Corporate Social Responsibility Affects Corporate Financial Performance. Sustainability, 7, 8292-8311.

Lin, L, Pi-Hsia, H., De-Wai, C., & Lai, C.W. (2018). Financial performance and corporate social responsibility: Empirical evidence from Taiwan. Asia Pacific Management Review, 1(11), 892-913. https://doi.org/10.1016/j.apmrv.2018.07.001

McWilliams, A., & Siegel, D. (2001). Corporate Social Responsibility A Theory of the Firm Perspective. Academy of Management Review, 26, 117-127. https://doi.org/10.5465/AMR.2001.4011987

Maqbool, S., & Zameer, M. (2018). Corporate social responsibility and financial performance: An empirical analysis of Indian banks. Future Business Journal, 4, 84-93. https://doi.org/10.1016/j.fbj.2017.12.002

Margolis, J. D, Elfenbein., H., & Walsh, J P. (2009). Does it Pay to Be Good. And Does it Matter? A Meta-Analysis of the Relationship between Corporate Social and Financial Performance. http://dx.doi.org/10.2139/ssrn.1866371

Meseguer-Sánchez, A., Abad-Segura, E., Belmonte-Ureña, L.J., & Molina-Moreno, V. (2020). Examen de l'évolution de la recherche sur les dimensions socio-économiques et environnementales de la responsabilité sociale des universités. International Journal of Environnemental Research and Public Health, 17, 4729. https://doi.org/10.3390/ijerph17134729

Mikołajek-Gocejna, M. (2016). The Relationship between Corporate Social Responsibility and Corporate Financial Performance–Evidence from Empirical Studies. Comparative Economic Research, 19(4), 67-84. https://doi.org/10.1515/cer-2016-0030

Mouatassim-Lahmini, H. (2018). Les stratégies de responsabilité sociétale des entreprises marocaines côtées à la bourse de Casablanca Performance Sociale—Performance Financière. Thèse de Doctorat Es Sciences de Gestions. Centre des Etudes Doctorales-FDC. Faculté des Sciences Juridiques, Economiques et Sociales de Casablanca. Université Hassan II.

Mouatassim-Lahmini, H., & Ibenrissoul, A. (2016). Y a-t-il un impact de la RSE sur la performance financière de l'entreprise : Etude empirique sur les sociétés marocaines cotées à la bourse de Casablanca. hal-01351951.

Nelling, E., & Webb, E. (2009). Corporate Social Responsibility and Financial Performance: The Virtuous Circle. Review of Quantitative Finance and Accounting, 32(2), 197-209. https://doi.org/10.1007/s11156-008-0090-y

Nollet, J., Filis, G., & Mitrokostas, E. (2016). Corporate social responsibility and financial performance: a non-linear and disaggregated approach. Economic Modelling, 52, 400-407. https://doi.org/10.1016/j.econmod.2015.09.019

Oyewumi, O., Ogunmeru, A., & Oboh, S. C. (2018). Investment in corporate social responsibility, disclosure practices, and financial performance of banks in Nigeria. Future Business Journal, 4, 195-205. https://doi.org/10.1016/j.fbj.2018.06.004

Peng, C. W., & Yang, M. (2014). The effect of corporate social performance on financial performance: The moderating effect of ownership concentration. Journal of Business Ethics, 123(1), 171-182. https://doi.org/10.1007/s10551-013-1809-9

Platonova, E., Asutay, M., Dixon, R., & Mohammad, S. (2018). The impact of corporate social responsibility disclosure on financial performance: Evidence from the GCC Islamic banking sector. Journal of Business Ethics, 151, 451-471. https://doi.org/10.1007/s10551-016-3229-0

Rodriguez-Fernandez, M. (2016). Social responsibility and financial performance: The role of good corporate governance. Business Research Quarterly, 19, 137-151. https://doi.org/10.1016/j.brq.2015.08.001

Schönborn, G., Berlin, C., Pinzone, M., Hanisch, C., Georgoulias, K., & and Lanz, M. (2019). Why social sustainability counts: The impact of corporate social sustainability culture on financial success. Sustainable Production and Consumption, 17, 1-10. https://doi.org/10.1016/j.spc.2018.08.008

Simionescu, L.N., & Cristian, G.Ș. (2014). Corporate social responsibility and corporate performance: empirical evidence from a panel of the Bucharest Stock Exchange listed companies. Management & Marketing. Challenges for the Knowledge Society, 9(4), 439-458.

Siew, R., Balatbat, M., & Carmichael, D. (2013). The relationship between sustainability practices and financial performance of construction companies. Smart and Sustainable Built Environment, 2(1), 6-27. https://doi.org/10.1108/20466091311325827

Soloman, R., & Hansen, K. (1985). It’s good business. New York: Atheneum.

Spence, L. J., Frynas, J. G., Muthuri, J. N., & Navare, J. (2018). Introduction. In L. J. Spence, J. G. Frynas, J. N. Muthuri & J. Navare, Research Handbook on Small Business social responsibility: Global perspectives. Cheltenham: Edward Elgar Publishing.

Taoukif, F. (2014). Analyse perceptuelle des déterminants de l’engagement sociétal des entreprises marocaines labellisées RSE. Thèse de doctorat en Sciences de Gestion. Université Moulay Ismail-Meknès/Université du Sud Toulon Var. Retrieved from https://tel.archives-ouvertes.fr/tel-01198977/document

Taleb, B. (2013). Les motivations d’engagement des entreprises dans la responsabilité sociale : le cas du secteur industriel algérien. Thèse de doctorat en Sciences de Gestion. AixMarseille Université

Vitezić, N., Vuko, T., & Mörec, B. (2012). Does financial performance have an impact on corporate sustainability and CSR disclosure – A case of Croatian Companies. Journal of Business Management, 5, 40-47.

Wahba, H., & Elsayed, K. (2015). The mediating effect of financial performance on the relationship between social responsibility and ownership structure. Future Business Journal, 1(2), 1-12. https://doi.org/10.7819/rbgn.v20i1.3600

Waworuntu, S.R, Wantah, M., & Rusmanto, T. (2014). CSR and financial performance analysis: evidence from top ASEAN listed companies. Procedia - Social and Behavioral Sciences, 164, 493–500. https://doi.org/10.1016/j.sbspro.2014.11.107

Williamson, D, Lynch-Wood, G., & Ramsay, J. (2006). Drivers of Environmental Behaviour in Manufacturing SMEs and the Implications for CSR. Journal of Business Ethics, 67(3), 317-330. https://doi.org/10.1007/s10551-006-9187-1

Wright, P., & Ferris, S. (1997). Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1), 77-83. https://doi.org/10.1002/(SICI)1097-0266