1. Introduction

Debt maturity has been a widely studied subject in corpo-rate finance. A large part of specialized literature has found that company characteristics, such as size, credit quality, asset tangibility, debt level, ownership structure and agency costs, are factors which determine corporate debt maturity.

Recently, a topic that has attracted the interest of researchers is the presence of foreign investors in companies’ ownership structure. This presence may have important effects on debt maturity, although limited international evidence has not been able to determine this relationship in a consistent manner. Some studies highlight that greater participation by foreign investors in corporate ownership leads to greater debt maturities (Ezeoha, Ogamba & Onyiuke, 2008; Li, Yue & Zhao, 2009; Tanaka, 2015). These studies argue that foreign ownership exercises a complementary supervisory role on long-term debt and that such monitoring can constitute great advantages and improvements to corporate management. On the contrary, other studies argue that the negative relationship between foreign ownership and debt maturity reflects the convergence of interest between managers and external shareholders. This convergence makes foreign ownership play a substitute monitoring role with long-term debt (Choi & Choi, 2013). Although there are several studies in Chile that analyze corporate debt maturity determinants, none have analyzed the potential effects of foreign ownership and its implications.

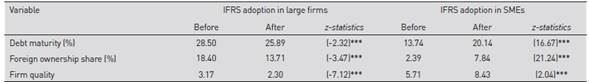

In Chile, the growth of opening trade and investor confidence in the country's institutions have led to increased foreign ownership of companies. According to World Bank data, between 2007 and 2015, foreign direct investments increased from 7.81% to 8.44%. Along the same lines, the presence of foreign investors in the ownership structure of Chilean companies also increased for the same period. This figure increased from 18.40% to 19.15% for large firms, while for small firms this rise was much more pronounced, increasing foreign investments from 2.35% to 8.12% (Table 1).

Table 1 Foreign ownership and direct foreign investment in Chile (average).

| Item | 2007 | 2009 | 2013 | 2015 |

|---|---|---|---|---|

| Large firms (%) | 18.40 | 11.54 | 15.45 | 19.15 |

| Small firms (%) | 2.35 | 2.47 | 7.52 | 8.12 |

| Direct foreign investment (% of GDP) | 7.81 | 8.10 | 7.57 | 8.44 |

Source: Longitudinal Business Survey and World Bank.

Changes in ownership structure have also coincided with the mandatory adoption of International Financial Reporting Standards (IFRS) by Chilean companies. The objective of converging financial reports with IFRS standards is to allow domestic and foreign investors to standardize accounting rules and international financial statement comparability (Bae, Tan & Welker, 2008; Bhat, Callen & Segal, 2016). Although there is a wide range of literature to support the significant advantages of IFRS adoption in reducing information asymmetries affecting investors, its effects on debt maturity have been scarcely discussed. Currently, the literature has not reached a clear conclusion. The positive effect on long-term debt generated by lower information asymmetry (Sengupta, 1998; Florou & Kosi, 2008; Kim, Tsui & Yi, 2011; Simmer de Lima, Sampaio & Gotti, 2018) is opposed to the negative effect with which IFRS mitigates agency conflicts through short-term debt (Zhang, 2008; Kosi & Florou, 2009; Chen & Zhu, 2013). In Chile, this matter has not yet been addressed. Moreover, differentiated adoption between large firms (since 2009) and small and medium enterprises (since 2013) may impose a differentiated effect of IFRS on the debt maturity of these firms. Given that small and medium enterprises (SMEs) are not obliged to report financial information, the degree of information asymmetry that characterizes them is greater when compared to large companies.

The general objective of our study is to determine the effects of foreign ownership and mandatory IFRS adoption on the debt maturity of Chilean companies. Our work contributes to national empirical literature and that of emerging markets in three aspects. First, we evaluate the effects of foreign ownership on debt maturity. Second, we evaluate the impact of mandatory IFRS adoption in both large companies and SMEs. It should be considered that adoption periods differ according to size. Third, we evaluate the interactive effects of foreign ownership and IFRS implementation according to firm size and credit quality. This point is to determine if these variables have conditional and interactive effects on debt maturity.

A grouped data set composed of 20,586 companies was used. This information was obtained from the Longitudinal Business Survey (LBS) for the 2007, 2009, 2013 and 2015 periods. Our results show that foreign ownership reduces debt maturity, which is consistent with the idea that investors use debt maturity to control agency costs. The effects of IFRS adoption differ according to firm size. In large firms, the adoption of this regulation reduces debt maturity, while in SMEs it increases it significantly. This effect is related to changes in information asymmetries since IFRS adoption by a firm. In any case, debt maturity increases when adoption occurs in firms with high credit quality. These results are relevant for firms, investors and policymakers. For firms and investors, our results help them to know the effects of foreign ownership on debt maturity as well as its control implications on corporate governance. It even allows them to know the relevance of IFRS in controlling information asymmetries, promoting foreign participation in corporate ownership and its impact on debt maturity decisions. In addition, regulators and policymakers can quantify the differentiated effect of IFRS according to firm size, and thereby strengthen policies aimed at facilitating firms’ access to debt with more favorable terms.

This article is structured as follows. Following the introduction, section 2 reviews the literature related to the effects of foreign ownership and the adoption of IFRS on debt maturity. This section also states the research hypotheses. Section 3 presents the data and analysis methodologies. Section 4 shows the results obtained. Finally, section 5 groups the conclusions of this article.

2. Theoretical framework and hypothesis

This section presents a literature review and research hypothesis derived from its analysis. This section has been divided into two parts. The first part details the theoretical and empirical evidence at an international level and analyzes the effect of foreign ownership on debt maturity. The second part focuses attention on studies, which analyze the impact of IFRS on debt maturity.

2.1. Effects of foreign ownership on debt maturity

Ownership structure is a fundamental determinant of the corporate debt maturity decision and its effects can hardly be separated from the agency problem. The degree of ownership concentration, either by controlling shareholders or by managerial participation in corporate ownership, can have positive or negative effects on debt maturity. Some studies argue that ownership concentration has a negative effect on debt maturity. This fact could be explained by the controlling effect of ownership concentration on company management being met through the issuance of short-term debt. This decision would inhibit the use of investment policies to expropriate wealth from various stakeholders (Ozkan, 2000; Guney & Ozkan, 2005; Jiraporn & Tong, 2008). On the contrary, other studies have argued that an increase in managerial or controlling shareholder ownership would lead companies to issue long-term debt as a way of entrenching corporate management (Shleifer & Vishny, 1986; Berger, Ofek & Yermack, 1997; Gompers, Ishii & Metrick, 2003; Datta, Iskandar-Datta, & Raman, 2005; Arslan & Karan, 2006; Benmelech, 2006; Harford, Li & Zhao, 2008; Tanaka, 2015). Despite the contradictory nature of this research, ownership structure continues to be relevant to debt maturity.

The effect of foreign ownership arouses investigative interest due to its increased relevance in recent years of gro-wing globalization (Schmukler & Vesperoni, 2006). Empirically, some works have highlighted that foreign investors parti-cipating in corporate ownership can assume the role of a relevant institutional investor capable of influencing corporate policies (Shleifer & Vishny, 1986; Gillan & Starks, 2003; Cronqvist & Fahlenbrach, 2009). In fact, several studies show that foreign ownership can have an important effect on various business areas such as corporate performance, dividend policy and firm value (Dahlquist & Robertsson, 2001; Chevalier, Prasetyantoko & Rokhim, 2006; Baba, 2009; Kimura & Kiyota, 2007; Jeon, Lee & Moffett, 2011; Cao, Du & Hansen, 2017).

Schmukler and Vesperoni (2006) point out that company access to international capital markets and national financial liberalization can have significant effects on the debt term decision. However, international evidence analyzing the effects of foreign ownership on debt maturity is still scarce and no consensus has been reached regarding this relationship. Some studies argue that foreign ownership has a positive effect on debt maturity, which is known as the foreign ownership monitoring hypothesis. Tanaka (2015) corroborates this relationship in a study of Japanese companies between 2005 and 2009. The author argues that foreign ownership is a means of control which disciplines corporate management, allowing them to access longer term debt and lower costs. In this case, foreign ownership prolongs its supervising function with the issuance of long-term debt. Although Jones (2006) warns that there may be conflicts between foreign and national owners, Li et al. (2009) argue that the described supervision effect has greater advantages, such as the attraction of new capital, technological improvements and corporate management. This view is also supported by Ezeoha et al. (2008).

Other studies indicate that foreign ownership has a negative impact on debt maturity, which supports the risk modification hypothesis. Relying on the theory of agency, these researchers have indicated that company administrators can expropriate wealth from bondholders through asset substitution. Nguyen (2012) states that, to mitigate this practice, bondholders shorten debt terms and foreign investors press firm managers to act in accordance with maximizing firm value. Choi and Choi (2013) developed a study for Korean companies that corroborated this negative relationship between foreign ownership and debt maturity. The authors add that foreign ownership promotes the convergence between managerial and external shareholder interests, replacing their oversight role with long-term debt.

Results are contradictory according to scarce literature available. However, according to Datta et al. (2005), ownership structure may have a non-linear effect on debt maturity. In our case, the percentage of existing foreign ownership could determine a specific effect on debt maturity. Ezeoha et al. (2008) and Tanaka (2015) argue that foreign ownership has a positive effect on debt maturity, in a study indicating that the percentage of foreign ownership in Nigerian and Japanese firms is 27.80% and 22.30%, respectively. On the contrary, Choi and Choi (2013) point out that foreign participation in Korean firms reaches only 9.07%. In Chile, according to the LBS, foreign ownership in companies reaches 6.87%. These facts lead us to propose the following hypotheses:

2.2. Effects of IFRS adoption on debt maturity

IFRS adoption can have significant effects on capital markets and participants. Decreased levels of information asymmetry and improvements in company transparency are usually attributed to IFRS adoption (Li, 2010; Daske, Hail, Leuz & Verdi, 2008, 2013). IFRS adoption has been more important for external investors than for companies themselves, since it affects their decisions and those of various financial system actors (Bhat et al., 2016). This relevance of IFRS is usually quantified, based on differences that separate it from local accounting criteria in terms of benefits and transparency policies on financial information disclosure (Chaplinsky & Ramchand, 2004; Ding, Hope, Jeanjean & Stolowy, 2007; Bae et al., 2008). Thus, the effects of implementing IFRS would be systemically more relevant for investors as differences are greater (Sengupta, 1998; Leuz & Verrecchia, 2000; Chen, Chen, Wang & Yao, 2015; Florou & Kosi, 2015).

Barth, Landsman and Lang (2008) and Hail, Leuz and Wysocki (2010) point out that mandatory IFRS adoption provides more detailed and internationally comparable financial information. This quality of regulation is a key factor in assessing investor risks (Dye, 1990; Verrecchia, 2001; Easley & O'Hara, 2004; Frost, 2007; Lambert, Leuz & Verrecchia, 2007; Ball, Bushman & Vasvari, 2008; De Franco, Vasvari & Wittenberg-Moerman, 2009; DeFond, Hu, Hung & Li, 2011). Leuz and Verrecchia (2000) and Chaplinsky and Ramchand (2004) add that these elements have important effects on the debt term contracts, such as cost and maturity, and that they are used to mitigate agency costs between firms and bondholders. International evidence is scarce and has not shown robust results regarding IFRS effects on debt maturity. The complexities imposed by institutional differences of the countries analyzed and the way in which they adopted IFRS could explain the discrepancy in the results.

Some literature has shown that the mandatory adoption of IFRS has a positive effect on debt maturity. Sengupta (1998) and Leuz and Verrecchia (2000) support this result, arguing that the reduction of information asymmetry reduces debt costs, encouraging the issuance of longer-term debt. Florou and Kosi (2008) find a similar result for firms in the United Kingdom, although their results lack significance. Kim et al. (2011), in a study carried out with companies from 40 countries with different legal origins between 1997 and 2005, show that IFRS are positively associated with long-term debt, although adoption has been voluntary. Simmer de Lima et al. (2018) analyzed 122 Brazilian firms, of which 93 adopted IFRS on a mandatory basis and 29 did so voluntarily. Their results show that the positive relationship between mandatory IFRS adoption and debt maturity is due to reductions in information asymmetry reducing investor risks through long-term debt. When adoption is voluntary, similar though more limited effects are found. On this point, the authors argue that mandatory IFRS adoption would have more relevant effects systemically than voluntary adoption, since the latter would be guided only by the willingness of companies to differentiate their quality from those who do not adopt those standards.

Other investigations have found contrary results to those described. Zhang (2008) points out that IFRS adoption imposes a more conservative accounting criterion and discourages discretionary policies aimed at wealth expropriation, which would be negatively correlated with debt maturity. This is supported by other empirical studies as well (Kosi & Florou, 2009; Ball, Xi & Shivakumar, 2014). Chen and Zhu (2013) corroborate this vision and add that IFRS are an effective means to mitigate the effects of the agency problem between firms and the bondholders. This effect may be more pronounced in countries with reduced legal protection for investors (Beneish, Miller & Yohn, 2015) or where IFRS show greater differences in relation to local accounting criteria (Chen et al., 2015).

In Chile there are no studies that have analyzed the relationship between IFRS adoption and debt maturity. Chile is a country governed by civil law, where the limited legal protection offered to investors can mean greater conflicts of interest between firms and debt holders, and have significant effects on debt contract terms. In addition, the fact that regulations are adopted differently by large companies and SMEs requires separating analyses for various reasons, which contrasts the need to reduce information asymmetry and control agency costs. First, the Commission for Financial Markets (CFM) requires large companies to disclose their financial statements on a quarterly basis. In line with Chen and Zhu (2013), this would make the asymmetry of information in large firms less than in SMEs. In addition, its diluted ownership structures and the presence of controlling shareholder would generate higher agency costs. In this case, IFRS could mitigate these costs by promoting a reduction on debt maturity for large companies. Thus, the following hypothesis was formulated:

Second, SMEs are characterized by more concentrated ownership structures that suggest a more limited effect of agency costs. However, since they are not required to report their financial statements, the degree of information asymmetry that characterizes them is greater. According to Sengupta (1998) and Leuz and Verrecchia (2000), if IFRS adoption helps reduce this information asymmetry, SMEs could access debts with lower financing costs and greater maturity. Therefore, we formulated the following hypothesis:

Since mandatory IFRS adoption provides more detailed and comparable financial information, the process of assessing risks and firm quality by investors is facilitated (Verrecchia, 2001; Easley & O'Hara, 2004; Lambert et al., 2007; Barth et al., 2008; Hail, 2010). If investors can assess firm quality with greater precision, then this means that information asymmetry is lower as well as the risk of their investment. This translates into a relaxation of debt contract terms, such as cost and maturity (Leuz & Verrecchia, 2000). This could be reinforced if foreign investors become a means of control, disciplining corporate management and allowing firms to access debt in more flexible terms (Tanaka, 2015). This leads us to formulate the following hypotheses:

3. Methodology

This section presents the data and econometric models used in this research. It has been divided into two parts. The first part details the firm sample and conceptual description of the variables according to empirical evidence. The second part presents the econometric methodology based on Fractional Response Model.

3.1. Data sample

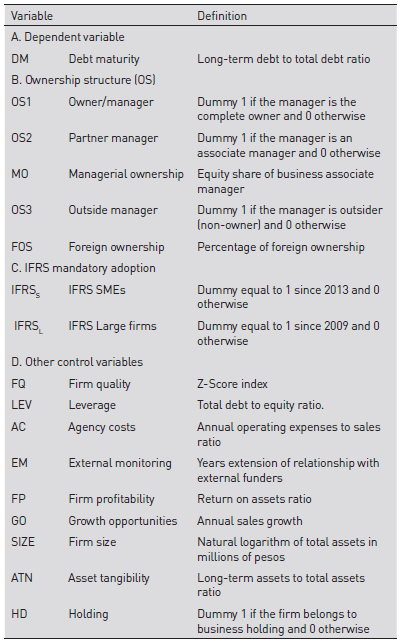

The data used in this investigation were obtained from the Longitudinal Business Survey (LBS). The information corresponds to the four versions of the database, LBS1, LBS2, LBS3 and LBS4, which report data corresponding to the 2007, 2009, 2013 and 2015 periods, respectively. This survey is prepared by the Ministry of Economy, Development and Tourism in Chile and only reports accounting and business information, but not information related to the stock exchange. The total sample is made up of 20,586 companies. This sample was obtained after eliminating companies with incomplete records from the financial sector. The data were grouped in a cross section of all the surveys because the companies can not be identified (the information was anonymous). The variables are presented in Table 2.

The dependent variable in the investigation is debt maturity (DM) measured by long-term debt to total debt ratio.

This measurement has been widely suggested by various national and international empirical works (Stohs & Mauer, 1996; Ozkan, 2000, 2002; Azofra, Saona & Vallelado, 2004; Dang, 2011; Muñoz & Sepúlveda, 2016).

Debt maturity is controlled through various measures of ownership structure (OS). Table 2 includes the dummy variables owner/manager (OS1), partner/manager (OS2), outside/manager (OS3) and the percentage of managerial ownership (MO). These variables have been used by several empirical works that attempted to quantify the effects of the separation of control and corporate ownership on debt maturity (Jensen & Meckling, 1976; Ozkan, 2000; Fleming, Heaney & McCosker, 2005; Guney & Ozkan, 2005; Datta et al., 2005; Benmelech, 2006; Harford et al., 2008). In these types of variables we also include the percentage of foreign ownership (FOS) to quantify the potential controlling role of these investors in business management through debt terms (Ezeoha et al., 2008; Choi & Choi, 2013; Tanaka, 2015).

Two dummy variables were used, which consider the differentiated implementation between SMEs and large companies, to control the effects of mandatory IFRS adoption on debt maturity. We defined IFRSS as a dummy variable with a value of 1 since 2013 and 0 otherwise; while IFRSL is a dummy variable that takes a value of 1 since 2009 and 0 otherwise. These years mark the periods in which both SMEs and large companies obligatorily adopted the IFRS.

Other control variables suggested by international evidence are also included. Firm credit quality (FQ) is quanti- fied through the Z-Score indicator (Flannery, 1986; Diamond, 1991); leverage (LEV) is used to corroborate whether debt maturity is related to liquidity or underinvestment problems (Johnson, 2003; Barclay, Marx & Smith, 2003; Billet, King & Mauer, 2007; Alcock, Finn & Keng, 2012); agency costs (AC) are used to measure the effect of managerial discretion on the principal-agent conflict (Leland, 1998; Lasfer, 1999; Ang, Cole & Lin, 2000; Fleming et al., 2005). Monitoring by external funders (EM) is used as an external control mechanism for debt maturity (Muñoz and Sepúlveda, 2016); firm profitability (FP) is measured through return on assets (Barclay & Smith, 1995); the annual growth of sales is used to quantify the role of firm growth opportunities (GO) according to several studies (Myers, 1977; Myers & Majluf, 1984; Barclay & Smith, 1995). We also include firm size (SIZE), asset tangibility (ATN) and holding company (HD) ownership.

3.2 Econometric method

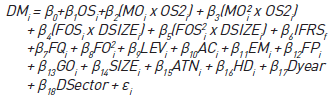

The fractional response model (FRM) proposed by Papke and Wooldridge (1996) was used to estimate the effects of foreign ownership and IFRS adoption on debt maturity. This model is used both to estimate probabilities and any type of continuous variable that can be represented as a ratio between 0 and 1, as in the case of debt maturity. The model for pooled data considers that this variable is restricted by a logistic distribution estimated by pseudo-likelihood. The empirical model is the following:

The dependent variable DMi indicates the debt maturity of firm i. The ownership structure dummy variables (OS i ) are defined according to what is indicated in Table 2. In addition, we include the managerial ownership (MO i ) and foreign ownership (FOS i ), as well as their quadratic level MO 2 and FOS i 2 to evaluate a possible non-monotonous effect of these variables on debt maturity. We use the dummy variable DSIZE, defined in two parallel ways, depending on whether the firm is large or SME. In this way, we control the observable heterogeneity between both types of companies. Note that managerial ownership is incorporated as a control variable only when the manager is a partner (OS2).

The IFRSf variable has a value of 1 since the year in which companies of size f = (L,S) 1 adopted the regulations and 0 otherwise, according to Table 2. These variables capture the contemporary, systematic and absorbing effect of this regulation on debt terms.

Other control variables based on specific company qualities are also included in the econometric analysis. The firm credit quality (FQi) and its square (FOS i 2 ), leverage (LEV i ), agency costs (AC i ), monitoring of external financiers (EM i ), firm profitability (FP i ), firm growth opportunities (GO]), firm size (SIZE i ), asset tangibility (ATN i ) and business holding company ownership (HD i ) constitute these control variables. The estimated model is also controlled by economic sectors (DSector) and temporal variations (Dyear), using dummy variables. Finally, εi is a random disturbance.

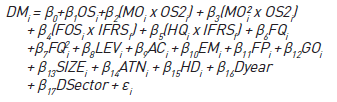

A second model was constructed to evaluate the effects of foreign ownership and firms with high credit quality since IFRS adoption. The following model was used:

The model (2) includes several interactive variables of interest for research. The variable (FOS i × IFRS f ) measures the effect of foreign ownership on debt maturity since size f = (L,S) firms obligatorily adopted IFRS, while the variable (HQ i × IFRS f ) measures the interactive effect of IFRS on firms with high credit quality, HQ i being a dummy variable which adopts the value 1 when the Z-Score of firm i is above the average of its sector and of its respective survey. The other control variables are defined identically to model 1.

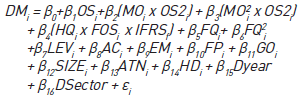

A third model was developed to assess the effects of foreign ownership on debt maturity in firms with high credit quality, which adopted IFRS:

Where (HQi × FOSi × IFRSf) is an interactive variable that measures the effect of foreign ownership on debt maturity since firms of size f = (L,S) and with high credit quality adopted IFRS. The other control variables are defined as in models (1) and (2).

4. Results

This section presents the empirical results of this re-search. It has also been divided into two parts. The first part presents the statistical analysis of the sample. The second part shows the effects of foreign ownership and IFRS adoption on debt maturity according to econometric model results.

4.1. Sample description

Table 3 presents the descriptive statistics of the sample. It is important to note that the results of each period are not strictly comparable due to differences in firm sizes used in the sample frame of each survey, and the fact that firms do not necessarily repeat from one sample to another.

It can be seen that the debt maturities of the companies included in the sample increased between 2007 and 2015. Long-term financing increased from 16.63% in 2007 to 22.72% of the total corporate debt in 2015. In any case, and despite the increase in debt maturity, short-term financing continues to be the most relevant in debt composition. Moreover, we observed that the debt-to-equity ratio also increased, evidencing the predominance of debt over the issuance of capital as a source of financing. In addition, the increase in years of commercial relationships with external funders, from 12.82 years in 2007 to 18.17 years in 2015, is consistent with the debt term structure.

The longer term of the observed debt also correlates with asset maturity. In 2007, 28.56% of company assets corresponded to long-term investments, increasing to 35.15% in 2015. This reveals that companies match financing maturities and those of their investments. Another fact that is interesting and common in countries governed by civil law (such as Chile), is the growing proportion of companies belonging to business holdings, increasing from 13.57% to 31.69% in the same period.

Information concerning ownership structure shows results that agree with the growing use of long-term debt. The reduction observed in the percentage of companies managed by their owner between 2007 and 2015 is proportional to the increase in the number of companies managed by an external manager and the reduction of managerial ownership. In addition, it can be seen that in the same comparative period, foreign ownership in Chilean companies increased from 3.75% to 9.20%.

Finally, we observe that, on average, Chilean firms have a low probability of bankruptcy given the figures from the Z-Score indicator. However, the growing evolution of agency costs and progressive reduction of growth opportunities are consistent with the greater long-term debt use and ownership dilution observed in the sample over the periods studied.

4.2. Effects of foreign ownership and IFRS adoption

IFRS adoption may not only affect the debt maturity of Chilean companies, but may also condition the role of foreign ownership and credit quality. Table 4 shows the results of the Wilcoxon test applied to large companies and SMEs, comparing the situation based on IFRS adoption. As seen for large firms, after the mandatory IFRS adoption long-term debt was reduced from 28.50% to 25.89%. In addition, there were significant decreases in foreign investor participation in corporate ownership and company credit quality. The opposite occurred for SMEs. Debt maturity, foreign owner-ship and credit quality of these companies increased after IFRS adoption. This result indicates that IFRS adoption corrects information asymmetries associated with firm quality. This correction also modifies the presence of foreign investors in company ownership. These results initially support the view that IFRS adoption can help differentiate firm quality and allows foreign investors to make better investment decisions.

Table 4 Wilcoxon test across mandatory IFRS adoption.

***, **, * indicate statistical significance at 1%, 5% and 10%, respectively.

Source: own elaboration

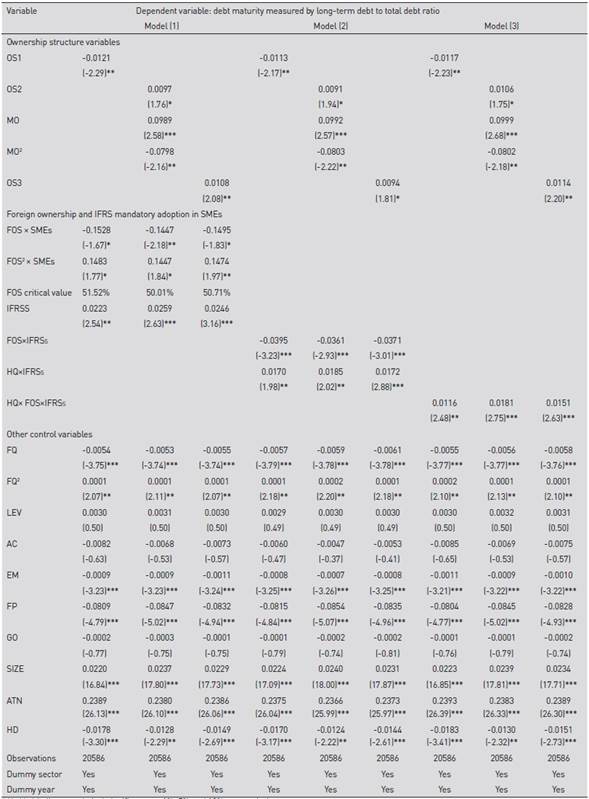

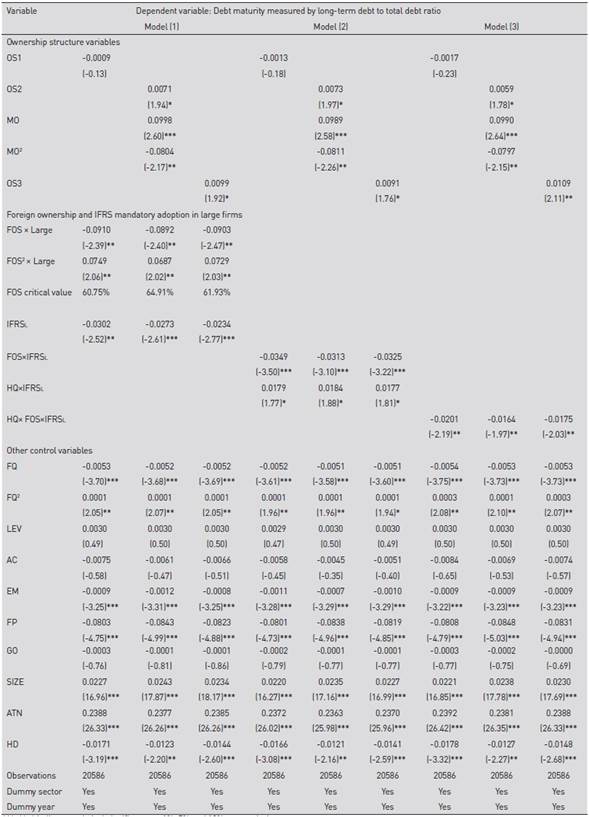

Tables 5 and 6 show the three specifications of the fractio-nal response model and their marginal effects. Dummy variables DSIZE and IFRS are defined for SMEs in table 5, while table 6 defines these variables for large firms. In both tables it can be seen that some control variables show expected effects according to empirical evidence. Firm characteristics such as credit quality (Flannery, 1986; Diamond, 1991), profitability (Barclay & Smith, 1995), external monitoring (Muñoz & Sepúlveda, 2016) and corporate holdings are factors that have a negative and significant impact on debt maturity. Therefore, firms with high credit quality (low risk) and greater profitability issue short-term debt. External monitoring and the creation of internal capital markets through corporate holdings also promote shorter term financing. This is relevant to the effects of firm credit quality. Although there is a negative effect on debt maturity, the observed nonlinearity suggests that firms with high credit quality prefer long-term debt. Other common results in both tables show that firm size (Benmelech, 2006; Alcock et al., 2012) and asset tangibility (Stohs & Mauer, 1996) have a positive impact on debt maturity.

Table 5 FRM for debt maturity in Chilean SMEs, marginal effects.

***, **, * indicate statistical significance at 1%, 5% and 10%, respectively.

Source: own elaboration.

Table 6 FRM for debt maturity in Chilean Large firms, marginal effects.

***, **, * indicate statistical significance at 1%, 5% and 10%, respectively.

Source: own elaboration.

Foreign ownership is relevant to debt maturity. The variable FOS indicates a negative and significant effect, which validates hypothesis H1. This result initially agrees with Choi and Choi (2013), in that foreign ownership generates convergence between managerial and foreign shareholder interests. In addition, foreign ownership exercises a supervisory role that can be substituted with the issuance of long-term debt. However, this relationship is non-linear, which supports hypothesis H2. The U shaped relation indicates that when foreign ownership is high, the negative effect is reversed and the emission of long-term debt is promoted in its place. For this, foreign ownership should be over 50% and 60% in SMEs and large companies respectively (see tables 5 and 6). On this threshold value, foreign ownership constitutes a means of complementary long-term debt control (Ezeoha et al., 2008; Tanaka, 2015).

IFRS have significant effects on debt maturity. However, these effects vary according to firm size. Table 5 indicates that mandatory IFRS adoption increases SME debt maturities, validating hypothesis H4. This result is in line with several international studies (Leuz & Verrecchia, 2000; Florou & Kosi, 2008; Kim et al., 2011; Simmer de Lima et al., 2018). Given that SMEs are characterized by a greater degree of information asymmetry, IFRS adoption exerts an effect that would transform the dissipation of said asymmetries into lower financing costs, encouraging the use of long-term debt. Table 6 shows that IFRS adoption has the opposite effect on large companies. This result supports hypothesis H3 and agrees with other empirical evidence (Zhang, 2008; Kosi & Florou, 2009; Ball et al., 2014; Chen & Zhu, 2013). Although large firms disclose financial information to the market, potential firm agency problems with investors make IFRS adoption an effective means to control them through the issuance of short-term debt. This is relevant for Chilean companies, since weak legal protections for investors can be partially compensated with the adoption of these standards.

Tables 5 and 6 show that variable (FOS i × IFRS f ) has a negative and significant effect on debt maturity. This result shows that the substitute control effect of foreign ownership prevails over debt maturity, even when firms of size f = (L, S) have obligatorily adopted IFRS. Although IFRS adoption translates into the disclosure of more detailed, comparable and transparent financial information, foreign owners consider this regulation as a means to reinforce their control through the issuance of short-term debt. On the other hand, the variable (HQi × IFRSf) indicates a positive and significant effect on debt maturity, which validates hypothesis H5. IFRS adoption promotes long-term debt when firms of size f = (L,S) have a high credit quality. This is complemented by the non-linear effect of firm credit quality (FQ) on debt maturity. Thus, mandatory IFRS adoption has a mitigating effect on information asymmetry, which is more pronounced in firms with high credit quality.

Finally, table 5 shows that the variable (HQi × FOSi × IFRSf) has a positive and significant effect on SMEs, supporting hypothesis H6. This result indicates that when foreign ownership increases in high-quality companies that adopt IFRS, debt maturities increase significantly. Foreign inves-tors associate firm quality and IFRS adoption with lower levels of information asymmetry in SMEs and issue longer-term debt as a monitoring mechanism. This is related to growing foreign ownership. On the other hand, table 6 shows that this variable has the opposite effect, in which the substitute control role of foreign ownership predominates. This last result in large firms contradicts hypothesis H6.

5. Conclusions

Debt maturity is a topic of recurrent analysis in corporate finance, mainly due to its scope on corporate control. Recently, new factors have influenced debt maturity decisions, opening new topics for debate and discussion.

Growing trade liberalization in Chile over the last two decades and the strengthening of its institutional framework and regulations have been fundamental pillars for increased foreign direct investments. In addition, recent mandatory IFRS adoption by large companies and SMEs in Chile has allowed the disclosure of more reliable, transparent and comparable financial information. These elements can have relevant effects on debt maturity decisions in Chilean companies, establishing a new research focus for this market. Furthermore, such effects are vital for debt maturity decisions by various investors, as well as how to determine the companies in which they should invest.

We analyzed the effects of foreign ownership and mandatory IFRS adoption on the debt maturity of Chilean companies. The contributions of our work and its implications for discussion are summarized in three aspects. First, our results indicate that foreign ownership has a negative and non-linear (U-shaped) effect on debt maturity. The negative relationship is observable for low foreign ownership levels, in which this type of ownership could exercise a substitute control effect with long-term debt. Chilean firms are characterized by low foreign ownership levels, which open spaces for wealth expropriation. Therefore, this negative relationship helps to reduce such spaces and promotes the convergence of firm and foreign owner interests through short-term debt issuance. This result becomes more relevant if we consider that Chile offers limited legal protection to non-controlling investors. In any case, when foreign ownership exceeds 50% in SMEs and 60% in large companies, the previous effect is reversed and becomes positive. Based on these threshold values, foreign investors take control of companies, complementing and prolonging their monitoring role through the issuance of long-term debt.

Second, mandatory IFRS adoption has significant effects on debt maturity, although these effects vary according to firm size. Debt maturity is reduced in large firms due to mandatory IFRS adoption, while in SMEs it increases. Our results suggest that the benefits of IFRS adoption (reducing information asymmetry and mitigating agency problems between investors and firms) are valued differently by these types of companies. Adoption by SMEs, which do not disclose financial information, reduces information asymmetries, allowing them to access longer-term debt. For large firms, agency problems are proportionally more relevant than information asymmetry, and therefore IFRS adoption is a means to mitigate them through short-term debt.

Third, even when firms have adopted the IFRS, foreign ownership maintains a negative effect on debt maturity. This result suggests that the perception of potential agency conflicts is relevant. However, when firms are distinguished according to their credit quality, it is observed that IFRS adoption promotes long-term debt. This indicates that IFRS adoption and the possibility of distinguishing firm credit quality is a sign of lower information asymmetry. This is valued by foreign investors in SMEs and is positively related to long-term debt. These findings confirm that, since the mandatory adoption of IFRS, foreign owners facilitate long-term debt in SMEs with high credit quality. On the contrary, the largest agency conflicts perceived in large firms require issuing short-term debt, regardless of firm credit quality. These results contribute establishing parameters to investors regarding the type of firms in which to invest, and how they should influence corporate decisions.

Our research has important implications for investors and regulators. For investors and owners, our work provides an empirical base allowing them to identify firms’ specific qualities for finance policy design, mainly in relation to size, credit quality and foreign ownership level. For regulators, it provides evidence of the relevance of the adoption of IFRS in debt maturity policy design, and how its application contributes differently to controlling risk factors such as agency costs and information asymmetry. Furthermore, our research provides evidence that supports policy design facilitating foreign investment in Chile, which may then establish or strengthen corporate control mechanisms.

Given the relevance of the IFRS and foreign ownership, it is important to extend this research into the potential effects of this standard on the corporate profit management of Chilean firms. The possibility of manipulating accounting information is a new focus of analysis and the role of foreign owners and the IFRS can be important regarding discretionary practices. Considering the weak legal protection offered by Chile’s institutional environment, the authors of this paper consider this an excellent avenue for further studies to explore.